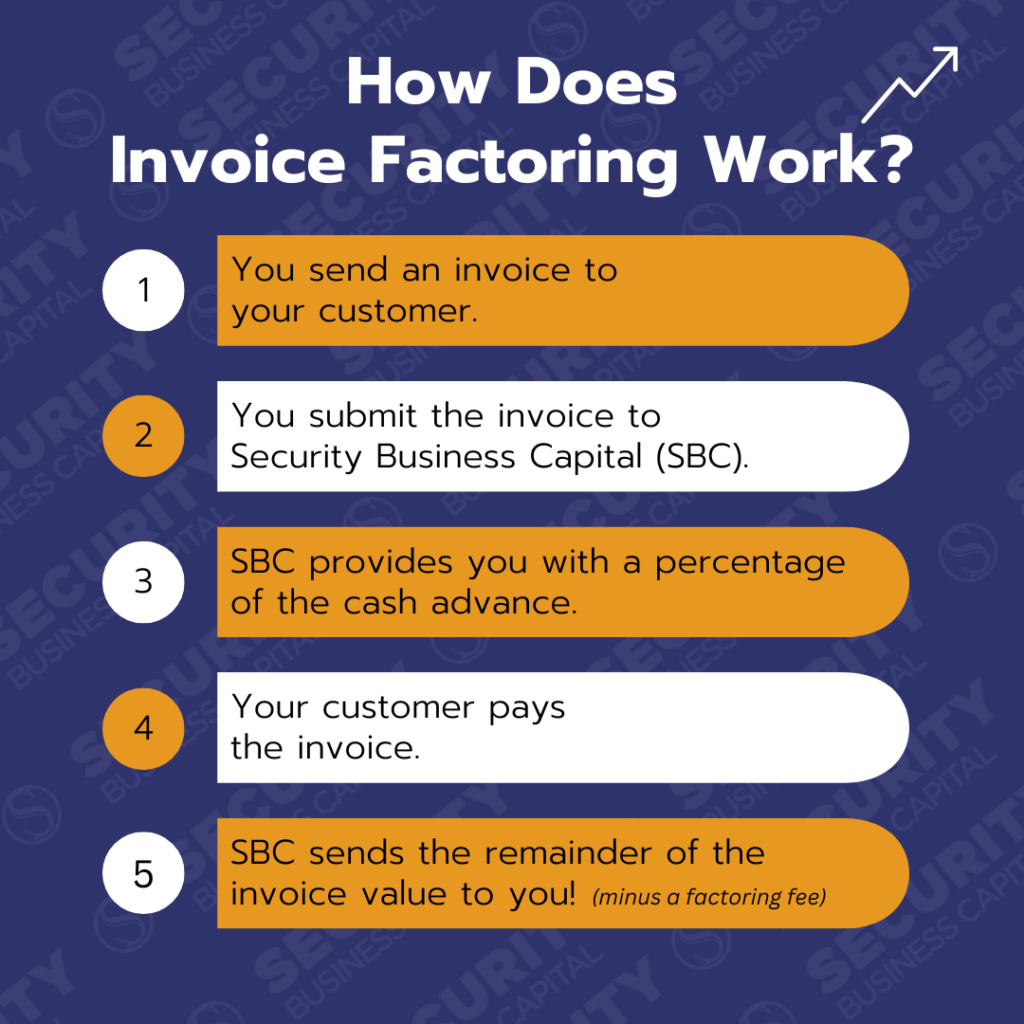

Invoice factoring has been around for thousands of years, and its origin goes back to merchants using such financing options in Mesopotamia. This form of financing is generated from a business’ unpaid invoices, which are assigned to an alternative lending company.

Security Business Capital’s flexible cash flow solutions allow you to turn your unpaid invoices into cash, oftentimes within 24 hours. No more waiting months for customers to pay!

Unlike a business finance loan or merchant cash advance, invoice factoring enables a company to convert your accounts receivable to immediate cash upon the completion of a sale of goods or for services rendered. This cash can be used for day-to-day expenses, fund payroll, buy additional inventories, or increase your sales and expand your business. This is not a loan and does not add any burden of debt.

Invoice factoring allows you to access cash fast, all without the headaches that come with applying for a traditional loan. Also called accounts receivable financing, factoring is a low-cost alternative to traditional capital financing, which can sometimes take weeks, or even months, to receive approval.

Working with Security Business Capital allows you to focus on your core business instead of worrying about hunting down customer payments. This provides you with a quick and easy way to access the cash you need to pay your bills on time, meet payroll, invest in new equipment, and grow your company.

When comparing invoice factoring to traditional lending, the advantages of factoring become clear. In addition to a low factoring finance fee, oftentimes this fee is only 1%-4% of the invoice amount, many of Security Business Capital’s invoice factoring clients actually reduce expenses by outsourcing credit and administration to Security Business Capital.

| Fast Approval Process (often same day or within 24-hours) |

| Will Work with Start-up Businesses |

Is Not a Loan, so Your Company Does Not Assume Any Debt |

Back Office Support at No Extra Charge |

| Greater Funding Availability |

| Time-Consuming Approval Process |

| New Businesses Start-ups Rarely Qualify for Traditional Loans |

Puts You in Debt - Negatively Affecting Your Balance Sheet |

You Handle Collections / Credit, and A/R management |

| Limited Funding Availability |

Factoring invoices makes good financial sense for businesses who want to access cash fast while limiting the debt and stress that comes with traditional lending. Here are the top reasons why accounts receivables factoring can work for you:

This flexibility lets you pay your employees and suppliers on time, as well as allows you to fill even more orders and increase your revenue. Security Business Capital gives your company the working capital it needs to survive and thrive.

Our clients also improve their financial condition, as factoring invoices for cash enables some businesses to “get current” or reduce strains caused by tight cash flow.

Talk to us today about our flexible invoice capital finance options that meet your specific circumstances.Contact Us Now for a Free Consultation!